DigiBank Accelerator –

Accelerate Your Digital

Transformation

Deploy ready-to-launch digital banking

applications in weeks, not years.

Why DigiBank Accelerator?

DigiBank Accelerator empowers financial institutions with a ready suite of digital banking apps—across Retail, SME, Corporate, Backend Ops, and BaaS. It fast-tracks time-to-market by digitizing customer journeys, modernizing channels, and enabling seamless integration. Whether you're upgrading legacy cores or launching new BaaS models, it delivers the speed, flexibility, and experience today’s market demands.

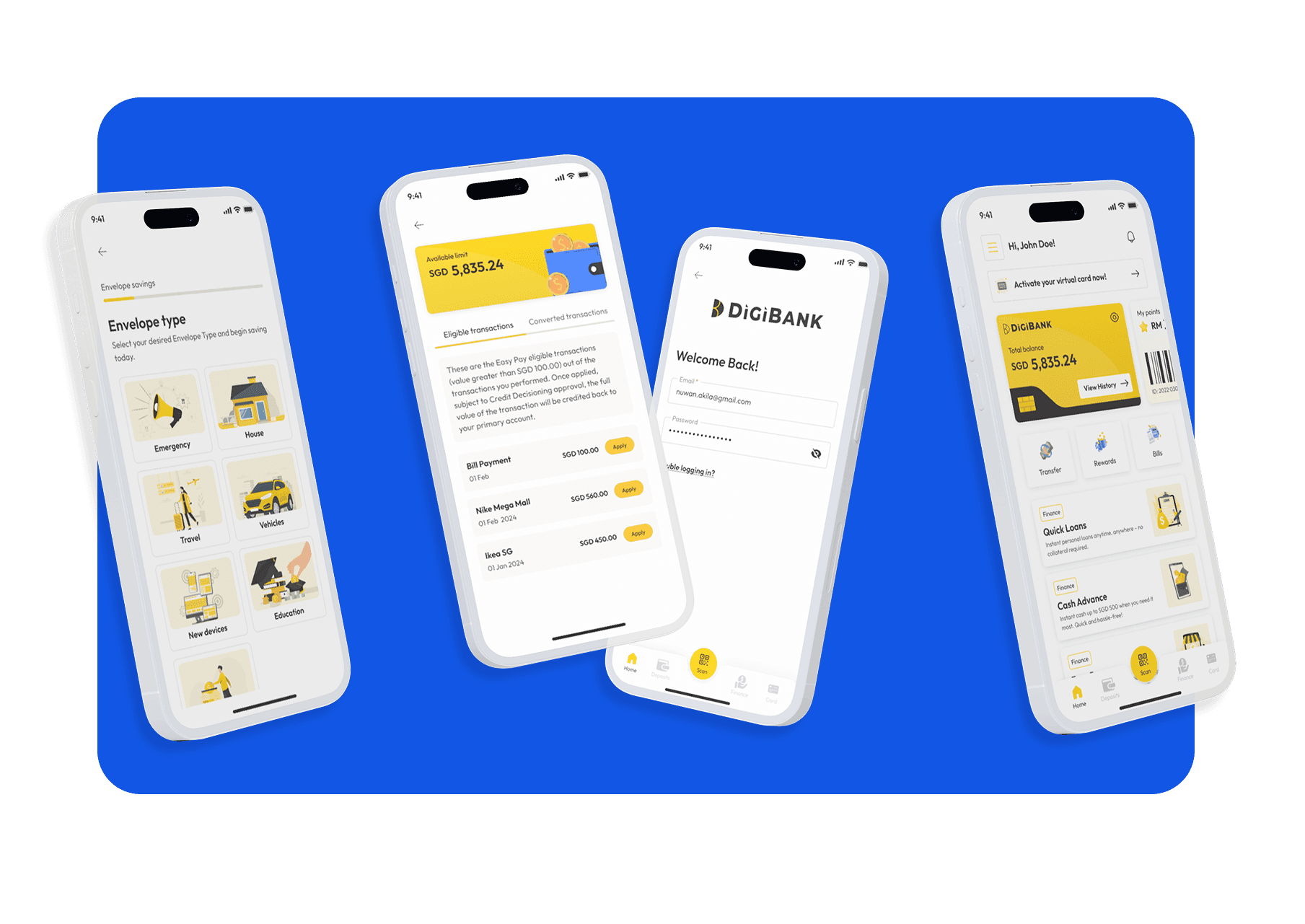

Digital Banking Applications

Engineered for Excellence

Digital Banking Applications -

Engineered for Excellence

White-label our ready-to-launch mobile banking apps for Retail and SME customers—featuring a sleek, intuitive UX, seamless digital onboarding, loan and deposit origination, P2P transfers, bill payments, and advanced budgeting tools. With modular APIs at the core, these apps offer complete flexibility to configure customer journeys tailored to your specific use case, enabling financial institutions to deliver next-gen mobile banking experiences at speed.

Corporate Banking Portals

– Monetize Payment Capabilities

Empower your enterprise clients with a modern, web-based portal to seamlessly onboard corporate customers and merchant partners, manage users and accounts, and oversee transactions with ease. Unlock new revenue streams by enabling monetizable corporate payments—like payroll, supplier, and bulk payouts—all through a seamless, intuitive interface.

Unified Admin & IAM Portal

– End-to-End Control

Run your digital bank with confidence using a unified admin portal built for scale and security. Gain centralized control over users and permissions, orchestrate workflows with maker-checker governance, and monitor real-time insights across customer data, configurations, and platform metrics. Launch new products—loans, deposits, cards—seamlessly with pre-built origination journeys, all from one powerful interface.

API Portal & Sandbox

– Powering Embedded

Finance Partnerships

Accelerate innovation with our robust API ecosystem—designed for fintech and embedded finance partners. Access developer-friendly documentation, test in real-time with sandbox environments, and streamline partner integration with built-in onboarding workflows, demo apps, and sample data. Everything you need to launch faster, scale smarter, and collaborate seamlessly.

Ideal for Banks, Financial

Institutions & Fintechs

Financial institutions

transitioning from legacy systems to cutting-edge digital solutions with a modern cloud-based architecture.

Banks looking to scale profitably

in retail and SME banking with new business models such as digital lending, embedded finance and neobanking.

Fintech innovators

looking for a reliable, quickly deployable banking infrastructure.

Digital transformation leaders

focused on launching banking services efficiently and at speed. Gain full control over configuration, testing, and scaling within a unified framework.

Powerful Integrations & Capabilities

Extensive API Ecosystem

- Identity, KYC/KYB, Payments, Banking, FRAML, and Customer APIs.

- Compatible with leading cloud providers (AWS, Azure, GCP) or on-premises deployments.

Enhanced Data Management

- Efficiently aggregate and manage extensive financial data, daily balances, and enterprise reference data.

Advanced Security & Compliance

- Secure identity management, robust fraud, and Anti Money Laundering (AML).

Agile, Event-driven Architecture

- Scalable and flexible microservices architecture ensuring agility and robust system performance.

- Pre-configured user journeys and business processes reduce the need for custom builds, enabling faster time-to-market.

Transform Your

Banking Operations

Rapidly Launch

New Digital Products

- Speed up your digital banking launches significantly compared to traditional platforms, swiftly meeting market demands and customer needs.

- Shorten innovation cycles, respond faster to market demands.

Simplify Integration

& Compliance

- Minimize disruption by integrating effortlessly with your existing operational systems.

- Pre-configured compliance and security protocols simplify integration processes, allowing your team to focus more on innovation.

Scale Effortlessly

& Sustainably

- Easily scale without extensive re-engineering, maintaining performance as your user base scales.

- Leverage future-proof architecture to adapt seamlessly to evolving technology and regulatory landscapes.

Frequently Asked Questions

Our DigiBank Accelerator can typically be deployed and go live within 8 to 16 weeks, allowing financial institutions to accelerate their digital banking transformation with minimal delay.

Yes, DigiBank Accelerator adapts to the use case and the context of the implementation. It offers multilingual capabilities, configurable UI templates, and flexible APIs to meet the specific needs of banks, fintechs, and other financial institutions.

DigiBank Accelerator includes comprehensive built-in support for key regulatory standards such as Know Your Customer (KYC), Anti-Money Laundering (AML), and Fraud detection and prevention, ensuring ongoing compliance in various jurisdictions.

Yes, DigiBank Accelerator offers robust multilingual capabilities, making it ideal for global banks and digital financial services providers operating across diverse markets.

Our DigiBank Accelerator supports a wide range of digital customer journeys, including digital customer onboarding, savings and deposits, digital lending, payments processing, and personal financial management (PFM).

Yes, DigiBank Accelerator supports flexible deployment options, including cloud-based solutions (AWS, Azure, GCP) as well as secure on-premises implementations to meet institutional IT policies.

Yes, DigiBank Accelerator features built-in analytics, real-time monitoring, and advanced reporting dashboards to help banks make informed, data-driven decisions.

DigiBank Accelerator is designed to serve multiple customer segments, including retail banking customers, SMEs (small and medium enterprises), and corporate banking clients.

Yes, DigiBank Accelerator is designed for seamless integration with legacy core banking systems, helping institutions modernize operations without major infrastructure changes.

Yes, DigiBank Accelerator includes dedicated technical support before, during, and after deployment, ensuring smooth implementation and ongoing operational success.

Take the Next Step

Transform your operations efficiently.