Corporate Payments –

Simplify Enterprise-Grade

Payment Infrastructure

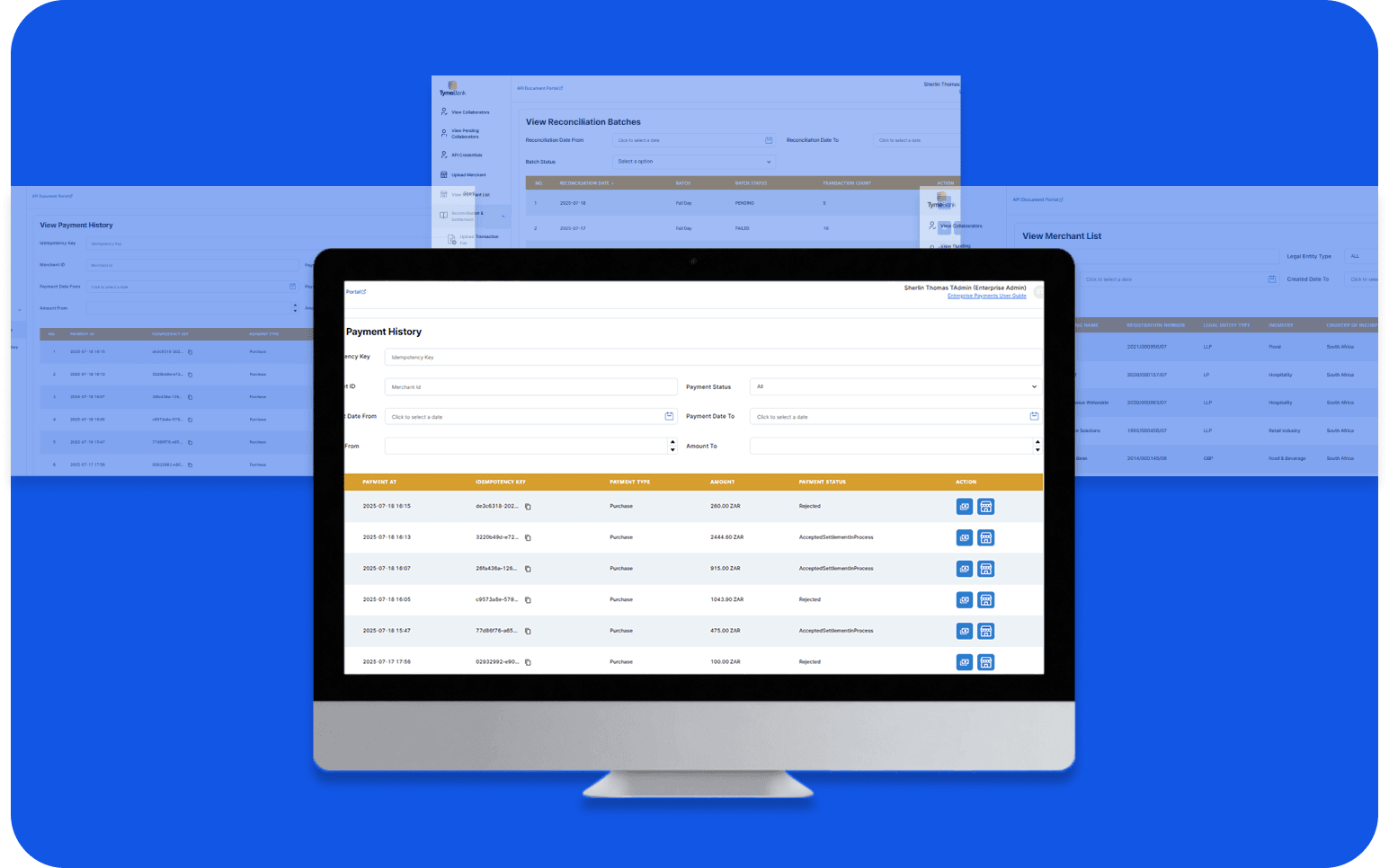

A powerful system for managing enterprise

payments, payroll, merchant transactions, and

partner settlements, all from one centralized

infrastructure.

Why Corporate Payments?

Corporate Payments by 101 Digital is an enterprise-ready payments platform designed to help financial institutions, TPPPs, and global businesses orchestrate, process, and reconcile large-scale payments. From payroll and government disbursements to B2B settlements and merchant payouts, the platform delivers real-time visibility, seamless onboarding, and robust reconciliation tools.

Built for Complexity,

Engineered for Simplicity

Onboard Third-Party

Payment Providers (TPPPs)

Full onboarding journey for partners: legal, commercial, sandbox access, and API setup.

Merchant Management &

Payouts

Easily register merchants, link payment rails, and process transactions across networks.

Real-Time Payment Execution

Initiate, monitor, and complete enterprise-level transactions via API orchestration.

Automated Reconciliation & Settlement

Match incoming and outgoing payment data, resolve exceptions, and close loops quickly.

Role-Based Admin Portal

Central dashboard with granular user permissions,

real-time views, and audit trails.

Full API Portal & Developer Toolkit

Publish, test, and manage APIs with full visibility into payment statuses and diagnostics.

Perfect for Enterprise-Grade

Payment Operations

Banks & financial institutions

managing bulk disbursements like payroll and vendor payments, and looking to monetize their payment capabilities.

Third-party payment providers (TPPPs)

needing seamless merchant onboarding, reporting, and merchant integration.

Large-scale merchants & marketplace

streamlining settlements, reconciliations, and payouts.

Cross-border payment processors

requiring scalable rails and compliance-ready APIs.

Technology Engineered

for Enterprise Integration

Modular, Scalable Core

- Connect to in-country banks and payment rails via bank adapters.

TPPP Portal

- Self-service API portal for partners with onboarding, testing, and transaction streaming.

Identity & Reconciliation Services

- FRAML, KYC/KYB, transaction matching, audit logging, and payment routing.

Integration-Ready APIs

- RESTful APIs with built-in monitoring, alerting, reporting, and diagnostic tools to streamline integration and operational visibility across large-scale payment flows.

Build for

Speed, Visibility & Control at Scale

Reduce

Operational Friction

- Automate reconciliation and simplify reporting with real-time tracking.

Scale

Seamlessly

- Process thousands of transactions daily while supporting compliance and customization.

Unified View

Across Payments

- One dashboard to track, manage, and audit all enterprise payment flows.

Faster Partner

Onboarding

- Accelerate time-to-market with dedicated onboarding flows for TPPPs and merchants.

Frequently Asked Questions

Corporate Payments supports a wide range of enterprise transactions, including payroll processing, merchant settlements, cross-border payments, vendor payouts, and bulk government disbursements.

Yes, Corporate Payments offers RESTful APIs and pre-configured integration adapters to seamlessly connect with your existing systems, enabling rapid deployment and scalability.

Corporate Payments includes a secure merchant onboarding portal that handles the full setup lifecycle, legal compliance, sandbox testing, and API integration, allowing partners to go live quickly and efficiently.

Yes, Corporate Payments automates reconciliation by matching inbound and outbound payments, identifying exceptions, and generating detailed reports for faster resolution.

Absolutely. Corporate Payments includes a role-based admin portal where user permissions, access controls, and audit trails can be customized to meet enterprise-grade governance needs.

Yes, Corporate Payments is cloud-native and supports hybrid deployment models, ensuring flexibility and scalability for enterprise environments.

Corporate Payments accelerates partner onboarding and payment execution by providing ready-to-use APIs, pre-built workflows, and a centralized dashboard, reducing launch cycles.

The platform offers real-time analytics covering payment flows, reconciliation status, user behavior, exception tracking, and operational diagnostics, helping stakeholders make data-driven decisions.

Yes, Corporate Payments is designed to handle both domestic and international payments, providing compliance-ready APIs and currency support for seamless global processing.

Yes, Corporate Payments is fully compliant with financial regulations, including AML, KYC, KYB, and fraud prevention measures, ensuring end-to-end transaction security.

Bring Efficiency

Control and agility to grow.